The markets returned their best weekly showing in 2.5 years to close at 5050, a net gain of about 7.2 pc. Are we out of the woods?Let us try and explore.

1. This stunning rally has been on the back of Domestic liquidity. DIIs have bought about 700 crores worth of shares whereas FIIs have sold to the tune of 110 crores. FIIs have sold for about 3 days of the 6 day rally.

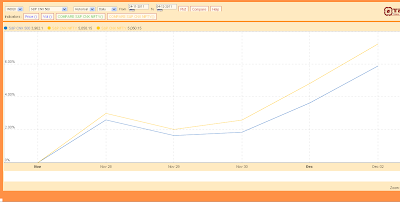

2. The Nifty has outperformed the broader market. The Nifty has gone about 7.2 % for the week whereas the broader CNX 500 has gone up by less than 6 %

3. The month of December has by and large been a very positive month for the equities. Since December 2002, the markets have always closed above the November close. This implies that this year if we go by history the markets should close above 4832. In all the years, the low for the month has always been below the previous month close. This implies that we should go down below 4832 at least once during the month.

4. If I try and project the average values, close should be around 5131, high at 5187 and low around 4731.

5. If we consider this up move as a retracement of the 5400-4639 fall then the next resistance to the up move comes at 5110.

6. In terms of number of sessions, the up move if it is an retracement should last for 6 to 10 sessions. 6 sessions are already over.

7. The logjam over FDI in retail will impact the markets negatively over the weekend. The next week should be either a flat or down kind of week.

For those interested in individual stocks or Gold, we have Lakshmi's Cherry Picks which are doing well.

Saturday, 3 December 2011

What does December hold for us?

Posted on 20:03 by Unknown

Subscribe to:

Post Comments (Atom)

0 comments:

Post a Comment