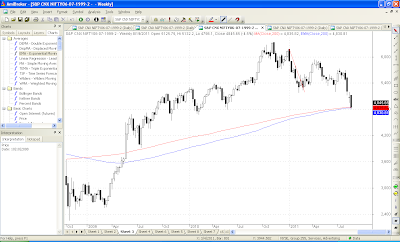

The Markets continued their downward journey last week. They fell by around by 4.5 % to close at 4845. Gold hit new all-time highs. So what next?

1. Gold has broken all previous all-time highs and is now trading at 1850 dollars and ounce or close to 28000 rupees levels. I would wait for a dip before making a fresh entry. I foresee a short term top close by. Make o mistake, in the next 1 year gold will go much higher but in the short term we may see a buying climax.

2. The Nifty is in the 3rd wave down which will culminate some time next week.

C wave so far.

Wave 1 - 5944 - 5196 = 748 points

Wave 2 - 5196 - 5741 = 545 points

Wave 3 - 5741 - 4796 = 945 points and ongoing

Wave 3 can be sub - divided into 5 waves

Wave 1 from 5744 - 5454 = 190 points

Wave 2 = 5454 - 5552 = 98 points

Wave 3 = 5552 - 4946 = 606 points

Wave 4 = 4946 - 5198 = 252 points

Wave 5 5198 - 4796 = 402 points and going on

After this, we will have the entire retrace of fall from 5740 - 4796 which can be a 500 - 600 point rally on the Nifty.

3. The Retracement levels of entire rise from 2252 to 6338 come to 4777, 4295 and 3812 levels.

4. 4690 - 4740 were the previous highs in the rally which started up. So, this area can prove to be a support zone.

5. All the indicators are now touching levels last seen in Jan 2009. So, either we bounce in a day or two or go much deeper.

6. The 200 week moving averages were last broken sometime in Sept 2008. We are now testing those averages. A weekly close below 4930 spells gloom.

7. On the upside, 2 gaps need to be closed. 4946 - 4846 and 5323 - 5204.

In a nutshell, now is the time to prepare shopping lists and nibble at stocks. The Diwali shopping list which we prepared last Diwali can be a good starting point for stocks.

Sunday, 21 August 2011

Markets Next Week: A bounce due

Posted on 05:52 by Unknown

Subscribe to:

Post Comments (Atom)

0 comments:

Post a Comment