The markets have fallen about 14 pc from the top. Now, what is the market trying to tell us. Lets have a fundamental and technical check of the markets. The markets are always ahead of the real economy. The situation we see in the markets now will reflect on the ground 6 months later.

1. The job market in the Sales and marketing sector has begun to dry up. This is an actual experience shared by someone I know. This implies companies have already begun to cut down on hiring. The Marketing budgets are usually the first to be cut.

2. Another of my associates works in a reputed broking firm. He is saying that broking volumes have shrunk to half the normal size and they are looking at cutting costs. Trading volumes are low means a lack of trader interest. Broking firms usually are the first to reflect the changed realities.

3. banking stocks have been taking a pounding. Bank reflect the economy. Certain high value acquisitions like ENAM takeover by Axis have happened. Fundamental wisdom suggests that such kind of sky high valuations happen at the peak of the markets.

4. There bull markets and bear markets. Bull markets peak when there is optimism all around and there are no worry clouds on the horizon. The perfect recipe which was prevailing.

5. Open the Economic Times and look at the number of stocks making 52 week highs and 52 week lows. The number of stocks making lows vastly outnumber the number of stocks making highs. This shows that the market is badly damaged.

6. The market discounts everything. The results and all have factored in, then why is the market not rising? The hiked loan rates on auto and home loan is going to hurt the vast middle class, those with 2 salaries and living on EMI culture.

7. The Mutual funds are stuck with KYC norms which means lot of new inflows into the market are stuck. There have been net purchases by domestic institutions of 4229 crores and selling by the FIIs of 7300 crores.

Technicals:

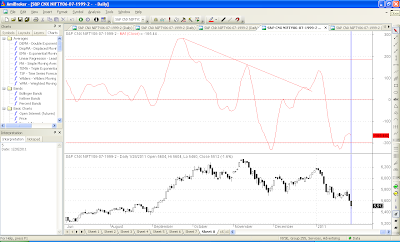

1. The markets have comfortably breached the 200 ema for 2 days now. The last breach came when we hit the low of 4786 in May'10. In the whole bull run, the market has breached the 200 ema only twice and the cuts are getting deeper.

2. Lets look how the market is placed in terms of % deviation between the close and 200 DMA. Its very close to the support line touched in May'10 but still some distance away which indicates some more downside before a technical bounce.

3. If we take 50 DMA, then the fall still has to touch the support line again indicating some more downside.

4. If we take the difference between 5 DMA and 20 DMA, we still have to reach the support zone. This means a further fall of 100-200 points before we get some kind of a bounce.

What do we do?

Use every bounce to get rid of longs and book profits on the portfolio. A sharp technical bounce is well round the corner. If you notice the period Jan-Mar-08. There was a bounce back which helped clean up the portfolio.

Lock into Gilt funds. Start a SIP into any good long term Gilt fund and wait out the storm. Good times are followed by bad times. Now is the time, to protect one's capital and wait for the perfect buying opportunity. One needs to prepare a wish-list of fundamental good stocks and start SIPPing into them.

Saturday, 29 January 2011

What are the Markets telling us: Fundamentally and Technically

Posted on 20:09 by Unknown

Subscribe to:

Post Comments (Atom)

0 comments:

Post a Comment