Over the last few weeks, several events which have occurred which are a reason to ponder over if not outright worry. Fundamentals do not change overnight but are a work in progress and suddenly one day the symptoms become apparent to all and the trend changes. The build up to such a trend change takes a long time.

Global factors:

1. The US came up with the QE-2 program of pumping in 600 billion dollars. This just confirmed the worst fears that the US dollar will be toilet paper sooner or later. Aything in excess is bad and excess dollar printing debases the value of the dollar. The only thing holding up the dollar is its safe have status. It just needs 1 event to trigger panic and have the world lose faith in the dollar. The event could be anything, war, economic collapse, trade wars.

2. Gold is the only safe haven. QE-2 demonstrates that. The price of gold has accordingly behaved the same. It has stayed above its previous peak of 1280 dollars for quite a few weeks.

3. Europe is in a bigger mess. Greece is gone, Ireland is gone. Portugal will be next and then Spain. As the economies get bigger, the bailouts will extract a bigger price. Spain bailout may well test the future of the Euro. Countries like Germany simply cannot continue to enjoy the advantage of a weak euro aiding their exports and not take the pain of supporting the weaker economies.

4. Japan is already talking of currency wars as their strong Yen is hurting their exports. China with its weak Yuan policy is already adding fuel to the fire.

5. Conflicts like the Korean are just small blips on the horizon. A conflict will hurt all parties concerned. Its mere shadow boxing. If it goes out of control, then we have a problem on the hands.

So far, the global crisis was a selling point for the Indian story of growth and 9 pc GDP. Over the last few weeks, the series of corruption crisis have severely dented Manmohan Singh's credibility.

Local:

1. The 2 G scam siphoned off huge sums of money from the Nation. What is even more worrying is the brazenness of those involved. The JPC probe demand is justified and necessary. JPC is answerable only to the Parliament and can summon even the PM. If the Congress has nothing to hide, why create such a row over JPC.

2.Adarsh scam has indicted the defense establishment. The judges of Allahabad High COurt are also under scrutiny. So far, it was an established fact, that politicians are corrupt, now the malaise is spreading to the pillars of the Indian society.

3. These events do not have an immediate impact. They have a domino effect and one day the Dominos fall.Already, Transparency International has lowered India's rating by 6 places. TI is a world renowned anti-corruption watch dog.Many MNCs base their decision to invest in a country on these ratings.

4. Victory of Nitish Kumar and its margin suggests the electorate supports good governance. Gujarat is also one more example of good governance. 9 pc GDP growth cannot be taken for granted. As I see, Congress may well lose the 2014 elections. Remember in 2004, Congress was written off. Similarly, history could repeat itself and NDA may well make a comeback with a reduced role for the BJP.

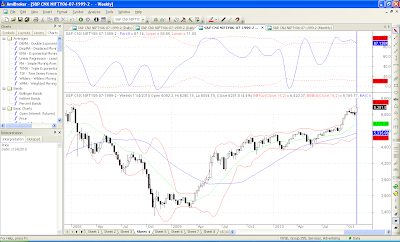

5. The FIIs have just withdrawn 4000 crores, less than a billion dollars and the markets have fallen 9 pc. This doesn't speak much of the depth of Indian markets. If FII selling intensifies, markets will just collapse. What is especially worrying is how midcaps have just collapsed. HCC from a peak of Rs 81 to Rs 40, loss of 50 pc and several more companies have fallen similarly. Just open Economic Times to see the number of companies making 52 week lows.

6. This butchering of the midcaps is what sets this correction apart from other corrections since Mar'09.

7. We may well have 1 more round of up move left. Caution bells are ringing loud and clear. Its time to take profits off the table, and also invest only in blue chips if you must.

Bullish scenario:

Bull markets end with a big bang. Remember Jan 2000 and Jan 2008. This time the fall is channeled, so just a correction.

Bearish scenario:

Sentiment has gone bad. Mid caps slammed. This normally doesn't happen in simple corrections.

Global factors:

1. The US came up with the QE-2 program of pumping in 600 billion dollars. This just confirmed the worst fears that the US dollar will be toilet paper sooner or later. Aything in excess is bad and excess dollar printing debases the value of the dollar. The only thing holding up the dollar is its safe have status. It just needs 1 event to trigger panic and have the world lose faith in the dollar. The event could be anything, war, economic collapse, trade wars.

2. Gold is the only safe haven. QE-2 demonstrates that. The price of gold has accordingly behaved the same. It has stayed above its previous peak of 1280 dollars for quite a few weeks.

3. Europe is in a bigger mess. Greece is gone, Ireland is gone. Portugal will be next and then Spain. As the economies get bigger, the bailouts will extract a bigger price. Spain bailout may well test the future of the Euro. Countries like Germany simply cannot continue to enjoy the advantage of a weak euro aiding their exports and not take the pain of supporting the weaker economies.

4. Japan is already talking of currency wars as their strong Yen is hurting their exports. China with its weak Yuan policy is already adding fuel to the fire.

5. Conflicts like the Korean are just small blips on the horizon. A conflict will hurt all parties concerned. Its mere shadow boxing. If it goes out of control, then we have a problem on the hands.

So far, the global crisis was a selling point for the Indian story of growth and 9 pc GDP. Over the last few weeks, the series of corruption crisis have severely dented Manmohan Singh's credibility.

Local:

1. The 2 G scam siphoned off huge sums of money from the Nation. What is even more worrying is the brazenness of those involved. The JPC probe demand is justified and necessary. JPC is answerable only to the Parliament and can summon even the PM. If the Congress has nothing to hide, why create such a row over JPC.

2.Adarsh scam has indicted the defense establishment. The judges of Allahabad High COurt are also under scrutiny. So far, it was an established fact, that politicians are corrupt, now the malaise is spreading to the pillars of the Indian society.

3. These events do not have an immediate impact. They have a domino effect and one day the Dominos fall.Already, Transparency International has lowered India's rating by 6 places. TI is a world renowned anti-corruption watch dog.Many MNCs base their decision to invest in a country on these ratings.

4. Victory of Nitish Kumar and its margin suggests the electorate supports good governance. Gujarat is also one more example of good governance. 9 pc GDP growth cannot be taken for granted. As I see, Congress may well lose the 2014 elections. Remember in 2004, Congress was written off. Similarly, history could repeat itself and NDA may well make a comeback with a reduced role for the BJP.

5. The FIIs have just withdrawn 4000 crores, less than a billion dollars and the markets have fallen 9 pc. This doesn't speak much of the depth of Indian markets. If FII selling intensifies, markets will just collapse. What is especially worrying is how midcaps have just collapsed. HCC from a peak of Rs 81 to Rs 40, loss of 50 pc and several more companies have fallen similarly. Just open Economic Times to see the number of companies making 52 week lows.

6. This butchering of the midcaps is what sets this correction apart from other corrections since Mar'09.

7. We may well have 1 more round of up move left. Caution bells are ringing loud and clear. Its time to take profits off the table, and also invest only in blue chips if you must.

Bullish scenario:

Bull markets end with a big bang. Remember Jan 2000 and Jan 2008. This time the fall is channeled, so just a correction.

Bearish scenario:

Sentiment has gone bad. Mid caps slammed. This normally doesn't happen in simple corrections.