Lets look at a few takeaways:

1. The markets rallied, but gold hit another all time high at 1262$. Typically gold should not be rallying when world markets are rallying. This implies smart money is buying gold and they may know something which we do not know.

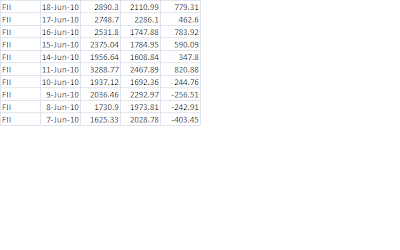

2. The dollar index has corrected from about 89.20 high made on June 7th around 86 levels. It has corrected about 4 pc from the highs and the FIIs have poured in around 3000 crores in the Indian markets. This flow is due to the Euro strengthening and the dollar weakening.

3. We would have to watch the Dollar Index for the next round of weakness in European markets. Our markets will simply dance to the tune of the European markets.

4. In spite of such a strong rally the weekly NMA has not yet given a buy signal. This signal is one of the most reliable I know on a weekly time frame. This is a cause for worry.

5. looking at the Open Interest, Thursday is F&O expiry, 5200 is the pivot with max OI built of puts and calls. I expect expiry to be in the range of 5150 to 5250.

6. The Oil Price hike is put and oil prices are rising. This bodes ill for the economy. Inflation is at 10 pc and rate hikes are inevitable.

7. The domestic economy is doing well and the shocks when they come have to come from the outside markets. BP is in a deep mess over the oil leak and they may eventually go bankrupt. The fine for 1 barrel of oil spilled in the US is 4000 USD and our men are spewing oil at almost 15000 barrels a day. BP is the RIL of the UK markets. Their pension funds depend on large dividends from BP. The UK markets can get a big hit if BP woes continue.

8. More and more countries are joining the debt crisis. Denmark, Bulgaria and Finland are the latest entrants. The risk of contagion spreads.

9. RIL plans to bid for UMPP ( huge power plants in excess of 4000 MW capacity) is good news. RIL is focusing on the wants of India, oil, petrochemicals, telecom, electricity. Its a proxy for the Indian economy and is my number 1 pick along with Gold.

In a nutshell, keep an eye on the Dollar Index and the European Markets. Till nothing happens there we continue on our merry ways.

0 comments:

Post a Comment