Fundamentals:

1. IIP Data of 16.8% can lead to a gap up on Monday. The government needs positive news as the IPO of REC is lined up to open on Friday Feb 19th. 4500 crores are going to be sucked out of the market.

2. The US is shut on Monday, so no global news flow on Tuesday. In Feb, the FIIs have sold 4000 crores and DII have bought 3000 crores. Attempts to prop up the markets till government finishes its divestment for this fiscal.

3. The Greece problems are far from over. A concrete plan is yet to be seen to bail out Greece. The problem does not end with Greece. What about the other bailout packages for Portugal, Spain ad party. There are protests in Greece against the planned clamp down on spending by Greece government. Greece does not print its own currency. The Euro is taking a hit for all this. Already weak GDP growth in Germany and Italy.

4. The Chinese Banks have again raised the lending rates, this was what started off the current slide a month back.

Fundamentals look a bit shaky right now globally. We still depend on the foreign funds. Time to be careful.

Technically:

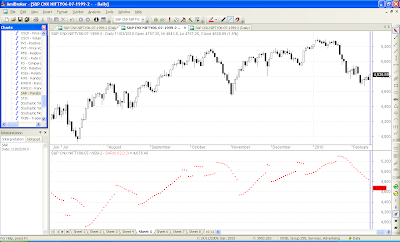

1. We ended the slide at 4675, a good 644 points from the top. The 200 EMA was not tested at 4654. 1 interesting thing I read today was that the first wave down usually does not break the 200 EMA. Some where from the 200 EMA, a relief rally originates. The Rally of Hope.

2. Thursday's rise was on very low volumes and more so on lack of FII selling than anything else.

3. The 20 EMA, 50 EMA and 100 EMA are at 4908, 4990, 4920. During bear runs, 100 ema is seldom violated on the upside and if violated, then for a very short time.

4. The retracement levels of the fall from 5310-4675 are at 4826, 4921, 4997 and 5072.

5. The Gann short term resistance comes at around 4900. If you see the long term Gann charts, then the pink dividing line has been violated for the first time since March.

6. The PSAR has given a buy signal. The NMA if the markets close above 4832 on Monday will give buy signals. Normally once these indicators give a buy signal, the market remains up for a few days at least.

7. The fall has taken 23 sessions. The up move should last at least 5-6 sessions. 3 sessions are already done with.If we consider the last down move from 4950, it took about 4-5 sessions. The current up move is already 3 sessions old. It should take out 4950 within the next 2 sessions, to imply its a fresh up move.

To summarize, 4900 - 5000 levels are strewn with resistances and one needs to be watchful after these levels.

0 comments:

Post a Comment