1. RBI hiked Repo Rates by 25 basis points and Reverse Repo by 50 basis points. Repo is the rate at which RBI lends to the banks and Reverse Repo is the rate at which it borrows from the commercial banks. The CRR or the Cash Reserve Ratio was left untouched.

2. The RBI sent out a message that further rate hikes were imminent. What does this all mean? It means for one that you would get more interest for your fixed deposits. Already many banks have started increasing the rate of FDs. The reason for doing this also because the credit growth is much than the deposit growth. There is also too much easy money available for speculative activities.

3. By increasing the rates, it would be more expensive for borrowers to borrow, thus cooling down the economy. The whole balancing act for the RBI is to keep the economy growth while at the same time not allow inflation to spiral out of hand.

4. Home loan and auto loans will rise though not immediately. The very fact that there have been 3-4 hikes this year and interest rates of loans have not gone up shows how much excess cash is there in the system.

5. The RIL results were just about ok. No great surprises. The surprises lie in the future with KG Basin gas, Shale gas, and the broadband activities. The stock reacted negatively to close about Rs 1015. If RIL does not rise, the market is going nowhere.

6. ONGC posted poor results on subsidy outflow. I would avoid this stock and go for Cairns instead which is pure Oil play.

7. The Options Pain came correct and we had this series expiry at about 5408. Remember usually the only guys who make money are the Option Writers.

8. The Result season is out, the monsoons are factored in. There are no triggers to move the market yet. The market will continue in this range for some more time or some negative news globally would bring the markets down.

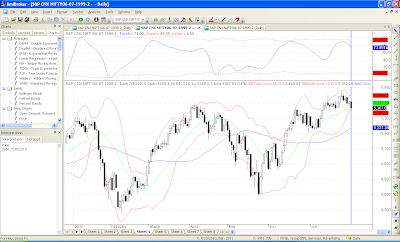

9. The Bollinger bands have contracted and the width is just 130 points. Last time such a contraction happened the markets tanked. Watch for the breach of 5352 or 5449 to go short or long. 5352 on the Nifty is crucial also because it is the low of past 3 weeks.