Tuesday, 29 June 2010

Saturday, 26 June 2010

Oil Price De-regulation: Is it really de-regulated?

Posted on 22:05 by Unknown

The government finally bit the bullet on Friday and not only hiked LPG, Kerosene, Petrol and Diesel prices but also deregulated Petrol prices. Leaving the jargon aside what does this mean to the common man and is it the big deal which is being made about? I do not think so and here is why?

1. The Petrol prices are deregulated means they will move in line with the International Crude prices. If crude goes to 100 dollars then our prices will move up. Now, what is the mechanism to do this? It is not very clear yet but the prices will be fixed once a fortnight. Each Oil Marketing company like Indian Oil, HPCL and BPCL is free to sell petrol at whatever prices they deem fit. This may mean one may get some small discount offers too. The Private retailers like Essar Oil and RIL can open their closed pumps too. Essar has announced that they would do so but RIL has very cautiously not made any comments.

2. The government saves a subsidy burden of Rs 24000 crores at current prices out of a total subsidy burden of 77000 crores. Now what is this subsidy? The subsidy means the government ensures that petrol was being sold at Rs 3.72 less than what it actually cost to import and sell. They were making good the losses suffered by the OMCs. There in lies the catch. Have a look at the below article from Hindu Business line. I was searching for updated material on this for quite sometime. For every 1 rupee the consumer pays oil, 45 paisa goes to the State and Central government as taxes. Now a tax of about almost 81 percent is way too high.

http://www.thehindubusinessline.com/2010/06/27/stories/2010062752210300.htm

3. So where is the subsidy? First you charge abnormal high taxes and then pay back the consumer a fraction of the amount. Like Petrol which was retailing at Rs 52 in Mumbai, about Rs 24 were taxes out of which government was paying you back Rs 3.72.

4. The government has not made it very clear what will happen if crude goes to 100-125 dollars a barrel? Also Diesel has been left out of deregulation for the time being. There are elections in Kerala, Tamil Nadu, W Bengal in May 2011. These 3 States account for about 100 Members of Parliament. The window for reforms will end in October-December time frame.

5. Now, Diesel there is a subsidy. What about Diesel cars whose market share is about 15 pc of the total car segment. Why should they get a subsidy? One way of targeting this is higher taxes when a brand new Diesel Car is sold making it less lucrative to opt for a Diesel car.

6. The positive side is that Oil marketing Companies losses will decrease, and the Retail Fuel segment would be much more competitive. Immediate downside is increase in the Inflation. The Rate Hike is almost a forgone conclusion. I expect a minimum 50 basis points hike i Repo and Reverse Repo Rates. The CRR may not be hiked immediately as the 3G Auctions and Advance Tax payments have taken out the liquidity from the markets.

7. After the price hike announced on Friday, the Banks were weak factoring in a Rate Hike. Fiis sold on Friday after a long time and so did the DIIs.

The Monsoons are here and are already priced in the markets on the positive side. The markets appear to be in a Range waiting for the next set of cues from the Global Markets. Inflation is in Double digits and that would put the brakes on the market for the time being. I would be long only after 5366-5400, the previous tops are taken out.

1. The Petrol prices are deregulated means they will move in line with the International Crude prices. If crude goes to 100 dollars then our prices will move up. Now, what is the mechanism to do this? It is not very clear yet but the prices will be fixed once a fortnight. Each Oil Marketing company like Indian Oil, HPCL and BPCL is free to sell petrol at whatever prices they deem fit. This may mean one may get some small discount offers too. The Private retailers like Essar Oil and RIL can open their closed pumps too. Essar has announced that they would do so but RIL has very cautiously not made any comments.

2. The government saves a subsidy burden of Rs 24000 crores at current prices out of a total subsidy burden of 77000 crores. Now what is this subsidy? The subsidy means the government ensures that petrol was being sold at Rs 3.72 less than what it actually cost to import and sell. They were making good the losses suffered by the OMCs. There in lies the catch. Have a look at the below article from Hindu Business line. I was searching for updated material on this for quite sometime. For every 1 rupee the consumer pays oil, 45 paisa goes to the State and Central government as taxes. Now a tax of about almost 81 percent is way too high.

http://www.thehindubusinessline.com/2010/06/27/stories/2010062752210300.htm

3. So where is the subsidy? First you charge abnormal high taxes and then pay back the consumer a fraction of the amount. Like Petrol which was retailing at Rs 52 in Mumbai, about Rs 24 were taxes out of which government was paying you back Rs 3.72.

4. The government has not made it very clear what will happen if crude goes to 100-125 dollars a barrel? Also Diesel has been left out of deregulation for the time being. There are elections in Kerala, Tamil Nadu, W Bengal in May 2011. These 3 States account for about 100 Members of Parliament. The window for reforms will end in October-December time frame.

5. Now, Diesel there is a subsidy. What about Diesel cars whose market share is about 15 pc of the total car segment. Why should they get a subsidy? One way of targeting this is higher taxes when a brand new Diesel Car is sold making it less lucrative to opt for a Diesel car.

6. The positive side is that Oil marketing Companies losses will decrease, and the Retail Fuel segment would be much more competitive. Immediate downside is increase in the Inflation. The Rate Hike is almost a forgone conclusion. I expect a minimum 50 basis points hike i Repo and Reverse Repo Rates. The CRR may not be hiked immediately as the 3G Auctions and Advance Tax payments have taken out the liquidity from the markets.

7. After the price hike announced on Friday, the Banks were weak factoring in a Rate Hike. Fiis sold on Friday after a long time and so did the DIIs.

The Monsoons are here and are already priced in the markets on the positive side. The markets appear to be in a Range waiting for the next set of cues from the Global Markets. Inflation is in Double digits and that would put the brakes on the market for the time being. I would be long only after 5366-5400, the previous tops are taken out.

Saturday, 19 June 2010

It was another positive week for the markets. The markets around the world rallied simply because there was no bad news, gold rallied and FIIs pumped in the dollars.

Lets look at a few takeaways:

1. The markets rallied, but gold hit another all time high at 1262$. Typically gold should not be rallying when world markets are rallying. This implies smart money is buying gold and they may know something which we do not know.

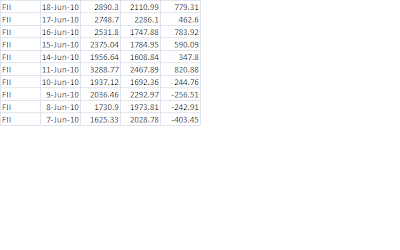

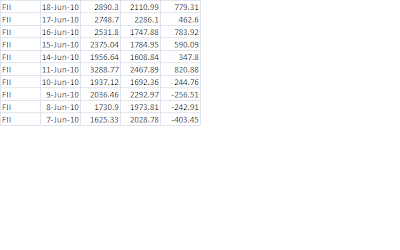

2. The dollar index has corrected from about 89.20 high made on June 7th around 86 levels. It has corrected about 4 pc from the highs and the FIIs have poured in around 3000 crores in the Indian markets. This flow is due to the Euro strengthening and the dollar weakening.

3. We would have to watch the Dollar Index for the next round of weakness in European markets. Our markets will simply dance to the tune of the European markets.

4. In spite of such a strong rally the weekly NMA has not yet given a buy signal. This signal is one of the most reliable I know on a weekly time frame. This is a cause for worry.

5. looking at the Open Interest, Thursday is F&O expiry, 5200 is the pivot with max OI built of puts and calls. I expect expiry to be in the range of 5150 to 5250.

6. The Oil Price hike is put and oil prices are rising. This bodes ill for the economy. Inflation is at 10 pc and rate hikes are inevitable.

7. The domestic economy is doing well and the shocks when they come have to come from the outside markets. BP is in a deep mess over the oil leak and they may eventually go bankrupt. The fine for 1 barrel of oil spilled in the US is 4000 USD and our men are spewing oil at almost 15000 barrels a day. BP is the RIL of the UK markets. Their pension funds depend on large dividends from BP. The UK markets can get a big hit if BP woes continue.

8. More and more countries are joining the debt crisis. Denmark, Bulgaria and Finland are the latest entrants. The risk of contagion spreads.

9. RIL plans to bid for UMPP ( huge power plants in excess of 4000 MW capacity) is good news. RIL is focusing on the wants of India, oil, petrochemicals, telecom, electricity. Its a proxy for the Indian economy and is my number 1 pick along with Gold.

In a nutshell, keep an eye on the Dollar Index and the European Markets. Till nothing happens there we continue on our merry ways.

Lets look at a few takeaways:

1. The markets rallied, but gold hit another all time high at 1262$. Typically gold should not be rallying when world markets are rallying. This implies smart money is buying gold and they may know something which we do not know.

2. The dollar index has corrected from about 89.20 high made on June 7th around 86 levels. It has corrected about 4 pc from the highs and the FIIs have poured in around 3000 crores in the Indian markets. This flow is due to the Euro strengthening and the dollar weakening.

3. We would have to watch the Dollar Index for the next round of weakness in European markets. Our markets will simply dance to the tune of the European markets.

4. In spite of such a strong rally the weekly NMA has not yet given a buy signal. This signal is one of the most reliable I know on a weekly time frame. This is a cause for worry.

5. looking at the Open Interest, Thursday is F&O expiry, 5200 is the pivot with max OI built of puts and calls. I expect expiry to be in the range of 5150 to 5250.

6. The Oil Price hike is put and oil prices are rising. This bodes ill for the economy. Inflation is at 10 pc and rate hikes are inevitable.

7. The domestic economy is doing well and the shocks when they come have to come from the outside markets. BP is in a deep mess over the oil leak and they may eventually go bankrupt. The fine for 1 barrel of oil spilled in the US is 4000 USD and our men are spewing oil at almost 15000 barrels a day. BP is the RIL of the UK markets. Their pension funds depend on large dividends from BP. The UK markets can get a big hit if BP woes continue.

8. More and more countries are joining the debt crisis. Denmark, Bulgaria and Finland are the latest entrants. The risk of contagion spreads.

9. RIL plans to bid for UMPP ( huge power plants in excess of 4000 MW capacity) is good news. RIL is focusing on the wants of India, oil, petrochemicals, telecom, electricity. Its a proxy for the Indian economy and is my number 1 pick along with Gold.

In a nutshell, keep an eye on the Dollar Index and the European Markets. Till nothing happens there we continue on our merry ways.

Saturday, 12 June 2010

Gold as an Investment

Posted on 22:38 by Unknown

Of late, we hear many stories about investing in Gold. In India, investing in Gold has come of age lately. In earlier times, gold was mainly used for jewelery in India. Let us attempt to find out if Gold can be a good investment.

Gold since time immemorial, as been used as a currency. People used to use gold as a currency in exchange for Gold. Till 1971, the US dollar was liked to the Gold Standard.

The gold standard is a monetary system in which a region's common media of exchange are paper notes that are normally freely convertible into pre-set, fixed quantities of gold.So for every dollar the US government printed they had to have an equivalent quantity of Gold.

Once the Gold standard was dropped, it lead to the debasement of the currency. The government could print as many dollars as they wanted, provided that there were taers for those dollars.

Gold is primarily used as a hedge against inflation, something which can be used as protection in times of crisis, something which has ever lost value.

There are several reasons why I am adding Gold to my portfolio:

1. Diversification

2. I have been noticing that Gold prices have kept going up in rupee terms since childhood. As late as 2005, I had bought gold for Rs 6500

3. The debasement of the currencies by the various governments. Some has to pick the tab somewhere. By flinging more money, you simply are delaying the problem.

4. Its made in limited quantities and Gold is one metal which makes people go crazy. Its not as if tomorrow you are going to find huge Gold reserves.

5. Limited supply and Indians keep hoarding Gold. I doubt if even 20 pc of the Gold Indians buy every year comes back in the market.

In any investment, I also look at the downside. Gold is not going to be Zero rupees. Worst case it may fall 20 pc. We have not yet entered the speculative blowout stage.

If we look at the gold charts from 1975, gold has gone up from 150 USD per ounce to 1200 USD now. A gain of about 8 times. This factoring in the booms of the economy and the recessionary trends as well.

With debt crises all over the world, it is not a bad idea to have some portion of the assets invested in Gold. One can look at the Exchange Traded Funds (ETFs) listed on the NSE as a safe way of investing. This does away with the headaches of storage and gives one liquidity as one gets cash for the sell in 2 days like any other stock.

The price of Gold is also linked to the strength of the US Dollar. This time, we are seeing a situation where both the Dollar is strengthening and still the price of Gold is going up.

If the rupee weakens against the dollar, the price increases in rupee terms even if globally the price does not go up.

Historically, 1 ounce of Gold buys you about 15 barrels of oil. By this ratio, the price of gold should be 1125 USD. The ratio may have extremes but the average point comes to about 10. So, soon, gold should come down slightly or crude oil prices should spike.

The all-time high of gold is 1252 USD. If gold sustains above this level, it would be time to add gold to one's portfolio.

A healthy portfolio is one which is well diversified, with stocks, fixed income investments, some amount of gold and maybe some real estate.

World over, money looks to find a safe haven in times of crisis. The US dollar is going up because as Europe is in a crisis, money finds US to be a safe haven. If US itself goes into crisis then what would be a safe haven for the money?

If you see this channel on the 100 year chart, for gold to touch upper channel it has to hit 6000 USD for an ounce.

Friday, 11 June 2010

RIL Acquisition of Infotel: A gamechanger

Posted on 23:07 by Unknown

RIL has acquired Infotel which is the only player with Broadband Wireless License across India.

This can be a game changer simply for the reason, that wireless is the way forward.

Quoting the ET:

The company is expected to use data technology in its roll out that would take around eight months after receiving spectrum. “A single 20 MHz TDD spectrum when used with LTE (Long Term Evolution) has the potential of providing greater capacity when compared to existing communication infrastructure in the country,” RIL said in a statement.

LTE is a technology patented by Qualcomm, like CDMA for cellular telephony which is what Reliance chose when it started services under Mukesh Ambani. Reliance Communications has since launched parallel services in GSM.

End of quote.

There are cost benefit. RIL controls more spectrum than any other operator and has acquired this at the 1/5th the price other paid for 3G.

Why is this spectrum cheap?

This is because no voice ca be carried over the spectrum of BWA. Already there are people talking about IP based telephony domestically which will further reduction in voice charges for end user.

There are no doubts in my mind over the following:

1. At the appropriate time, government policy will be tweaked to allow voice services by BWA players.

2. The future is wireless and corporate data usage will be a big revenue generator

3. RIL Telecom operations would be spun off as a subsidiary once it attains critical mass.

Other than Bharti, RIL now also becomes a buy due to its Telecom foray.

RIL now has oil and gas plus telecom. Try and visualize life without oil and gas and telecom.

This can be a game changer simply for the reason, that wireless is the way forward.

Quoting the ET:

The company is expected to use data technology in its roll out that would take around eight months after receiving spectrum. “A single 20 MHz TDD spectrum when used with LTE (Long Term Evolution) has the potential of providing greater capacity when compared to existing communication infrastructure in the country,” RIL said in a statement.

LTE is a technology patented by Qualcomm, like CDMA for cellular telephony which is what Reliance chose when it started services under Mukesh Ambani. Reliance Communications has since launched parallel services in GSM.

End of quote.

There are cost benefit. RIL controls more spectrum than any other operator and has acquired this at the 1/5th the price other paid for 3G.

Why is this spectrum cheap?

This is because no voice ca be carried over the spectrum of BWA. Already there are people talking about IP based telephony domestically which will further reduction in voice charges for end user.

There are no doubts in my mind over the following:

1. At the appropriate time, government policy will be tweaked to allow voice services by BWA players.

2. The future is wireless and corporate data usage will be a big revenue generator

3. RIL Telecom operations would be spun off as a subsidiary once it attains critical mass.

Other than Bharti, RIL now also becomes a buy due to its Telecom foray.

RIL now has oil and gas plus telecom. Try and visualize life without oil and gas and telecom.

Saturday, 5 June 2010

Reliance Industries - A good buy

Posted on 05:12 by Unknown

I was looking at good companies to buy and one company which stands out is Reliance Industries. There are several compelling reasons why I am bullish on this stock.

1 of the basic rules of good fundamental investing is that we should buy a good company with sound management in a good sector.

Now lets looks at the business model of RIL. It operates in the oil and gas space and its original segment of petrochemicals. If you look at the latest balance sheet, it speaks of 3 main lines of business:

1. E&P - Exploration and Production

2. Refining

3. Petrochemicals business

Out of their turnover for 2009-2010, 65% came from refining, 20% from petrochemicals and about 5 % from oil and gas production.

Now RIL has 1.6% of the refining capacity of the world. The refining margins for RIL was 6.6 USD per barrel a premium of 3.1 dollars over the Singapore GRM. Now, the refining margins are a play on the price oil and oil prices are going to go up and we may see 100 USD per barrel rates in the not too distant future.

The Petrochemical business is the original building block of RIL. It is the world's largest producer of polyester staple fibre and filament yarn.

The Oil and Gas business is what excites me and is the kicker for the future. The share of revenues is just 5 % now. The government has fixed the Natural Gas prices at 4.2 USD per mm BTU. This will directly benefit RIL in the KG Basin gas delivery. The court case with RNRL is finished.

Beside, it is ow exploring Shale Gas by doing a JV with Atlas in the US.

Further information about Shale Gas ca be obtained from below link:

http://en.wikipedia.org/wiki/Shale_gas

The earning per share for the company for the current financial year was about Rs 49 and the market price is Rs 1030.

The Reliance Retail has more than 100 stores spread across 85 cities across India. The profits from this venture as and when they accrue are a bonus. Take out Relaince Retail and still RIL is a huge winner.

The success of RIL depends on high crude oil prices, favorable government policies and good management. Looking at the past history, I wonder if anyone is willing to take a bet whether the above 3 factors will continue to benefit RIL.

Now, when to buy RIL. The global markets are dodgy and we do not how the deep the correction could be. The best bet is to to do a SIP in this stock. Its a stock to be kept for the next 10 years.

1 of the basic rules of good fundamental investing is that we should buy a good company with sound management in a good sector.

Now lets looks at the business model of RIL. It operates in the oil and gas space and its original segment of petrochemicals. If you look at the latest balance sheet, it speaks of 3 main lines of business:

1. E&P - Exploration and Production

2. Refining

3. Petrochemicals business

Out of their turnover for 2009-2010, 65% came from refining, 20% from petrochemicals and about 5 % from oil and gas production.

Now RIL has 1.6% of the refining capacity of the world. The refining margins for RIL was 6.6 USD per barrel a premium of 3.1 dollars over the Singapore GRM. Now, the refining margins are a play on the price oil and oil prices are going to go up and we may see 100 USD per barrel rates in the not too distant future.

The Petrochemical business is the original building block of RIL. It is the world's largest producer of polyester staple fibre and filament yarn.

The Oil and Gas business is what excites me and is the kicker for the future. The share of revenues is just 5 % now. The government has fixed the Natural Gas prices at 4.2 USD per mm BTU. This will directly benefit RIL in the KG Basin gas delivery. The court case with RNRL is finished.

Beside, it is ow exploring Shale Gas by doing a JV with Atlas in the US.

Further information about Shale Gas ca be obtained from below link:

http://en.wikipedia.org/wiki/Shale_gas

The earning per share for the company for the current financial year was about Rs 49 and the market price is Rs 1030.

The Reliance Retail has more than 100 stores spread across 85 cities across India. The profits from this venture as and when they accrue are a bonus. Take out Relaince Retail and still RIL is a huge winner.

The success of RIL depends on high crude oil prices, favorable government policies and good management. Looking at the past history, I wonder if anyone is willing to take a bet whether the above 3 factors will continue to benefit RIL.

Now, when to buy RIL. The global markets are dodgy and we do not how the deep the correction could be. The best bet is to to do a SIP in this stock. Its a stock to be kept for the next 10 years.

Subscribe to:

Comments (Atom)