Lets look at the fundamentals:

1. Fundamentals do not change overnight. They are a series of factors which takes weeks, months and years to play out. On the Indian markets nothing has changed much. The Monsoons are the next trigger. A good monsoon is somewhat factored in, but a delay would trigger a sell off.

2. Europe looks to be descending the black hole. Spain has unemployment of 20 pc and the ratings downgrade late Friday set off a slide. The number of countries in trouble are expanding.

3. The things looking good right now for me is the Oil and Gas sector. Oil prices will move higher with the US problems with Offshore drilling and RIL is my top pick to capitalize on this sector.

4. The US treasuries yield came down for the 30 year bond. This showed its a flight to safety and quality. People are willing for lower returns in order to safeguard their capital.

5. The Dollar Index spiked up and the came down a bit. The FIIs were sellers on the first two days of the rally and then finally turned buyers on Friday. This flow is crucial in seeing if we continue rallying.

6. 2010 began with Nifty at 5200, now we are at 5078. It about 5 months we have gone nowhere. Just moved in a range of 4700-5400. The breaking of this range would suggest 6100 or 4000.

Technically:

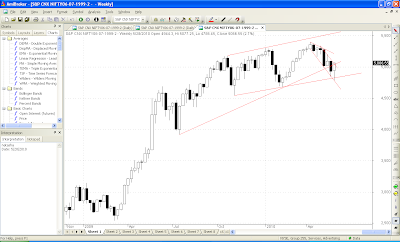

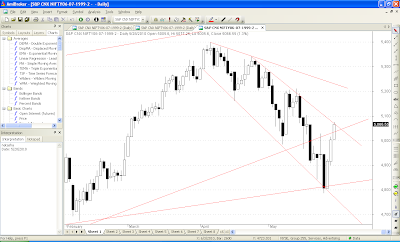

1. The jury is out whether the correction is over and we proceed on another leg up. Have a look at the daily channel down. We are consistently hitting both the bottom and the top of the channel. The bottom is around 4720 levels now. If we do not breach 5105 we may head down.

2. 5105 is a key figure because it was the previous top about 2 weeks back. Shorts can keep that as a stop loss.

3. We are below all the key averages of 50 ema and 100 emas which come at 5107 and 5080. Once these are taken out we can explore the bullish options.

4. The Daily indicators like Parabolic SAR, NMA have either given a buy or are on the verge of giving a buy signal. This is what makes the next 2 days very crucial in deciding the outlook for June for the markets.

5. One very interesting feature is that the Nifty futures are at a discount of almost 25 points to the spot price. This is rarely seen. Dividends of shares will take out about 7 points discount. In such markets its the option writers who make money.

An example is say any At the Money Call Option, example 5000 strike call, when market was at 5000 June series was trading at 170 rupees on Tuesday and same is ow about 134. 40 points just shaved off. The above example is just an illustration to show how the premium is decreasing.

6. Gann indicates strong supports around 4750 on a weekly closing basis.

A breakout above 5105 may leads to further upsides.

0 comments:

Post a Comment