Saturday, 27 February 2010

Friday, 26 February 2010

Good Budget

Posted on 08:56 by Unknown

In balance, the budget was a good budget. I say it was a good budget for the following reasons.

1. The relaxing of the Income Tax slabs was a very welcome move. It puts in more money in the hand of the common man. More money means more expenditure. This will increase demands for goods and services.

2. No change in the Service Tax at 10 pc. This is welcome because the increase to 12 pc would have hit the common man. There should be other ways of generating revenue.

3. No tinkering with the Capital Gains structure. The new Direct Tax code and GST roll out as per schedule.

4. The hike in Excise duty of 2 pc means gradual rollback of stimulus. That would work wonders for our Fiscal Deficit.

5. Increase in excise on cars and petrol is welcome.

6. Banking licenses to be doled out. This is welcome news.

7. Roadmap for reducing public debt in 6 moths. This signals the intent to reduce fiscal deficit.

In the limited canvas, it was a good budget under the circumstances. The Markets should rally a bit to 5050-5100 levels. The further cues would be from the global markets as well the mega disinvestment of NMDC which should suck out 15000 crores.

I had got a question why markets would expire the Feb series around 4800+-50 points. It finally expired at 4858. Max Open Interest was at 4800. That means Puts written plus calls written at srike 4800 were more than at any other strike. Now, usually the big institutions and the market makers write the options. They would lose the least if markets expired around this strike. Thats what happened.

Today the Option writers made the money. The Puts were butchered and the Calls didnt increase in value.

1. The relaxing of the Income Tax slabs was a very welcome move. It puts in more money in the hand of the common man. More money means more expenditure. This will increase demands for goods and services.

2. No change in the Service Tax at 10 pc. This is welcome because the increase to 12 pc would have hit the common man. There should be other ways of generating revenue.

3. No tinkering with the Capital Gains structure. The new Direct Tax code and GST roll out as per schedule.

4. The hike in Excise duty of 2 pc means gradual rollback of stimulus. That would work wonders for our Fiscal Deficit.

5. Increase in excise on cars and petrol is welcome.

6. Banking licenses to be doled out. This is welcome news.

7. Roadmap for reducing public debt in 6 moths. This signals the intent to reduce fiscal deficit.

In the limited canvas, it was a good budget under the circumstances. The Markets should rally a bit to 5050-5100 levels. The further cues would be from the global markets as well the mega disinvestment of NMDC which should suck out 15000 crores.

I had got a question why markets would expire the Feb series around 4800+-50 points. It finally expired at 4858. Max Open Interest was at 4800. That means Puts written plus calls written at srike 4800 were more than at any other strike. Now, usually the big institutions and the market makers write the options. They would lose the least if markets expired around this strike. Thats what happened.

Today the Option writers made the money. The Puts were butchered and the Calls didnt increase in value.

Tuesday, 23 February 2010

The budget rally continues..

Posted on 22:30 by Unknown

Friday, 19 February 2010

All Eyes on the Budget

Posted on 22:21 by Unknown

It was a rangebound week with markets trading in a band of 150 points. The only folks who made money this week were the option writers. Lets see what the next week brings for us.

Fundamentals:

1. The REC IPO will suck out money from the Domestic institutions.The Domestic institutions were sellers the past 2 days.

2. The FED in a surprise move increased the Discount rate by 25 points. The rate at which member banks may borrow short term funds directly from a Federal Reserve Bank. The discount rate is one of the two interest rates set by the Fed, the other being the Federal funds rate. The Fed actually controls this rate directly, but this fact does not really help in policy implementation, since banks can also find such funds elsewhere. also called discount rate.

3. This may be the start of the tightening policy in the US. The dollar strengthened and Dollar Index is at about 81. Dollar indiex is inversely proportional to the Indian Stock Market. The Index was 89 when our markets bottomed and at 74 when our markets hit the October highs. The Index has got back half the losses it made.

4. The Dollar Carry Trade would be dead. Borrowing at low interest rates i US and putting that money to work in India does ot work when the Dollar is rising.

5. The Budget is expected to get rid of some of the stimulus measures. Expect selling in the markets if the stimulus measures are curtailed.

Technicals:

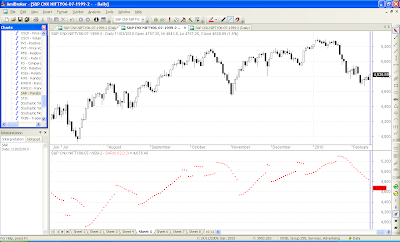

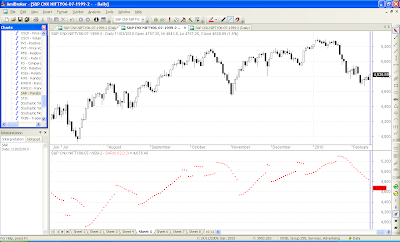

1. Heavy Call Writing at 4900 ad 5000 levels. Put writing at 4700 and 4600 levels. The max OI is at 4800 strike price when both Puts and Calls are added up. This means the expiry should be around 4800 +/- 25 points.

2. The Short term Gann charts resistance at 4915 was tested this week. Next support comes at previous lows.

3. The long term Gann charts offer support at around 4740.

4. The markets breached the 20 ema on its way up but for the second time was resisted at 100 ema. Have a look at the long term charts and see the significance of 100 ema.

5. Next week, expect a range bound movement till the budget.

6. If 5310-4675 was 1 wave down, 4675-4930 is 40% retracement of that. The Wave 3 may have started or if wave 2 a was 4675-4930, b 4930-4802, c could be 5057.

If the stimulus stays, short term rally else fall continues.

Fundamentals:

1. The REC IPO will suck out money from the Domestic institutions.The Domestic institutions were sellers the past 2 days.

2. The FED in a surprise move increased the Discount rate by 25 points. The rate at which member banks may borrow short term funds directly from a Federal Reserve Bank. The discount rate is one of the two interest rates set by the Fed, the other being the Federal funds rate. The Fed actually controls this rate directly, but this fact does not really help in policy implementation, since banks can also find such funds elsewhere. also called discount rate.

3. This may be the start of the tightening policy in the US. The dollar strengthened and Dollar Index is at about 81. Dollar indiex is inversely proportional to the Indian Stock Market. The Index was 89 when our markets bottomed and at 74 when our markets hit the October highs. The Index has got back half the losses it made.

4. The Dollar Carry Trade would be dead. Borrowing at low interest rates i US and putting that money to work in India does ot work when the Dollar is rising.

5. The Budget is expected to get rid of some of the stimulus measures. Expect selling in the markets if the stimulus measures are curtailed.

Technicals:

1. Heavy Call Writing at 4900 ad 5000 levels. Put writing at 4700 and 4600 levels. The max OI is at 4800 strike price when both Puts and Calls are added up. This means the expiry should be around 4800 +/- 25 points.

2. The Short term Gann charts resistance at 4915 was tested this week. Next support comes at previous lows.

3. The long term Gann charts offer support at around 4740.

4. The markets breached the 20 ema on its way up but for the second time was resisted at 100 ema. Have a look at the long term charts and see the significance of 100 ema.

5. Next week, expect a range bound movement till the budget.

6. If 5310-4675 was 1 wave down, 4675-4930 is 40% retracement of that. The Wave 3 may have started or if wave 2 a was 4675-4930, b 4930-4802, c could be 5057.

If the stimulus stays, short term rally else fall continues.

Monday, 15 February 2010

Nifty 15th Feb, 2010

Posted on 09:57 by Unknown

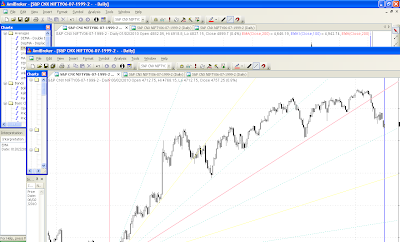

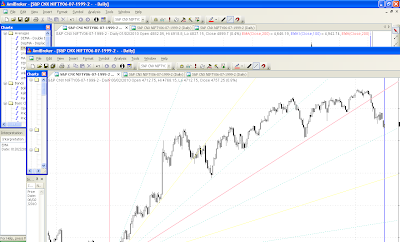

The market continues to remain choppy. Nifty continues to trade in a narrow range and finds support within the pink channel. This is our positive scenario until the support is violated (support exists at 4750). We continue to face stiff resistance at 4835.

The market continues to remain choppy. Nifty continues to trade in a narrow range and finds support within the pink channel. This is our positive scenario until the support is violated (support exists at 4750). We continue to face stiff resistance at 4835.IIP numbers were great (17%) -but the upmove wasn't strong enough to take out 4835 on a closing basis. Volumes continue to diminish, indicating lack luster.

Nifty will continue to remain choppy all of this week until we see a decisive break (preferably on the downside).

Taking out 4835 will only lead to our next target of 4940. This in my opinion will be a good opportunity to short the index. However, moving below 4740 will again lead to a shorting opportunity for lower targets of 4450.

What do the indicators say?

1. RSI - continues its feeble attempt to inch up along the wedge.

2. MFI - Taking support along the trendline. A break in the trendline on the downside will lead to a fall in the index.

Friday, 12 February 2010

Short Term Relief Rally on Cards

Posted on 22:12 by Unknown

The short-term bleeding seemed to be taking a break this week. Lets see what are the factors both fundamentally and technically which will drive our markets next week.

Fundamentals:

1. IIP Data of 16.8% can lead to a gap up on Monday. The government needs positive news as the IPO of REC is lined up to open on Friday Feb 19th. 4500 crores are going to be sucked out of the market.

2. The US is shut on Monday, so no global news flow on Tuesday. In Feb, the FIIs have sold 4000 crores and DII have bought 3000 crores. Attempts to prop up the markets till government finishes its divestment for this fiscal.

3. The Greece problems are far from over. A concrete plan is yet to be seen to bail out Greece. The problem does not end with Greece. What about the other bailout packages for Portugal, Spain ad party. There are protests in Greece against the planned clamp down on spending by Greece government. Greece does not print its own currency. The Euro is taking a hit for all this. Already weak GDP growth in Germany and Italy.

4. The Chinese Banks have again raised the lending rates, this was what started off the current slide a month back.

Fundamentals look a bit shaky right now globally. We still depend on the foreign funds. Time to be careful.

Technically:

1. We ended the slide at 4675, a good 644 points from the top. The 200 EMA was not tested at 4654. 1 interesting thing I read today was that the first wave down usually does not break the 200 EMA. Some where from the 200 EMA, a relief rally originates. The Rally of Hope.

2. Thursday's rise was on very low volumes and more so on lack of FII selling than anything else.

3. The 20 EMA, 50 EMA and 100 EMA are at 4908, 4990, 4920. During bear runs, 100 ema is seldom violated on the upside and if violated, then for a very short time.

4. The retracement levels of the fall from 5310-4675 are at 4826, 4921, 4997 and 5072.

5. The Gann short term resistance comes at around 4900. If you see the long term Gann charts, then the pink dividing line has been violated for the first time since March.

6. The PSAR has given a buy signal. The NMA if the markets close above 4832 on Monday will give buy signals. Normally once these indicators give a buy signal, the market remains up for a few days at least.

7. The fall has taken 23 sessions. The up move should last at least 5-6 sessions. 3 sessions are already done with.If we consider the last down move from 4950, it took about 4-5 sessions. The current up move is already 3 sessions old. It should take out 4950 within the next 2 sessions, to imply its a fresh up move.

To summarize, 4900 - 5000 levels are strewn with resistances and one needs to be watchful after these levels.

Fundamentals:

1. IIP Data of 16.8% can lead to a gap up on Monday. The government needs positive news as the IPO of REC is lined up to open on Friday Feb 19th. 4500 crores are going to be sucked out of the market.

2. The US is shut on Monday, so no global news flow on Tuesday. In Feb, the FIIs have sold 4000 crores and DII have bought 3000 crores. Attempts to prop up the markets till government finishes its divestment for this fiscal.

3. The Greece problems are far from over. A concrete plan is yet to be seen to bail out Greece. The problem does not end with Greece. What about the other bailout packages for Portugal, Spain ad party. There are protests in Greece against the planned clamp down on spending by Greece government. Greece does not print its own currency. The Euro is taking a hit for all this. Already weak GDP growth in Germany and Italy.

4. The Chinese Banks have again raised the lending rates, this was what started off the current slide a month back.

Fundamentals look a bit shaky right now globally. We still depend on the foreign funds. Time to be careful.

Technically:

1. We ended the slide at 4675, a good 644 points from the top. The 200 EMA was not tested at 4654. 1 interesting thing I read today was that the first wave down usually does not break the 200 EMA. Some where from the 200 EMA, a relief rally originates. The Rally of Hope.

2. Thursday's rise was on very low volumes and more so on lack of FII selling than anything else.

3. The 20 EMA, 50 EMA and 100 EMA are at 4908, 4990, 4920. During bear runs, 100 ema is seldom violated on the upside and if violated, then for a very short time.

4. The retracement levels of the fall from 5310-4675 are at 4826, 4921, 4997 and 5072.

5. The Gann short term resistance comes at around 4900. If you see the long term Gann charts, then the pink dividing line has been violated for the first time since March.

6. The PSAR has given a buy signal. The NMA if the markets close above 4832 on Monday will give buy signals. Normally once these indicators give a buy signal, the market remains up for a few days at least.

7. The fall has taken 23 sessions. The up move should last at least 5-6 sessions. 3 sessions are already done with.If we consider the last down move from 4950, it took about 4-5 sessions. The current up move is already 3 sessions old. It should take out 4950 within the next 2 sessions, to imply its a fresh up move.

To summarize, 4900 - 5000 levels are strewn with resistances and one needs to be watchful after these levels.

Sunday, 7 February 2010

Nifty 8th Feb 2010

Posted on 21:35 by Unknown

Nifty - A relief rally this week..?

This week we may see a brief rally upto 4800 / 4850 / 4900 / 4950 (trade in the pink channel). We may see upmoves within this channel upto levels mentioned above.

Trend can reverse if the pink channel is broken -ve on a closing basis.

The overall trend remains bearish until 5185 is taken out and Nifty trades above this level for over 3 days.

10 day RSI is trading within a wedge. We may see RSI move to 45 / 50 over the next couple of days. Money Flow index has broken the channel is now facing resistance at 20.

Our ultimate target on Nifty remains at 3800. However, if 4400 holds we may see the begining of a new upmove.

Saturday, 6 February 2010

Sell on Rallies

Posted on 19:56 by Unknown

The Markets had a roller coaster ride last week. It has now become a sell on rallies kind of market. There are several reasons for this. Lets try and go through them. We will try and have a fundamental and technical look at the reasons.

1. The FIIs have been relentlessly selling. One of the reasons for the rise from march'09 was the FII money pumped in. The month of Feb already, they have sold Rs 2500 crores and for this year, almost 9500 crores from Jan'10.

2. The DIIs have propped up the market with purchases of Rs 13,500 crores. How long can they prop the market up?

3. The NTPC issue was a disaster. It got a subscription of 12000 crores against shares on offer worth 9000 crores. 4500 crores were pumped in by LIC and SBI. The government still has mega issues this financial year like REC, Sutlej Nigam which will suck the out the buying power of LIC.

4. The Dollar Index is above 80. The Dollar Carry Trade is unwinding. The easy money is gone.

5. PIGS are getting slaughtered.The problems of Portugal, Greece, Spain and Ireland are undermining the Euro. The sovereign debts of these countries can potentially tear apart the European Union. If the Euro falls, the USD is the only alternative now.

6. The Dollar strengthening makes the Emerging Markets as an unattractive investment class. The FIIs have to sell more shares to get the same amount of dollars back.

7. The Silver lining is India is better positioned to handle all this than rest of the world.

Technicals:

1. The 200 EMA at 4654 is likely to be tested this time. Bulls live above this average, the bears thrive below it. The attached chart is interesting. In bull markets, the markets take support on this level and rally. The behavior of the index at 4650 is key.

2. The 20 EMA and 50 EMA negative crossover has happened.In the bull market, this never happens.

3. The Gann supports are at 4650 taken at major turning point in March'09.

4.Short term Gann Resistance comes at 4850 which could be a shorting level.

5. The Index broke the Trendline support of lows from August which gave us support when the low of 4766. This offers first resistance at 4775 approx now. Next resistance comes at at the upper end of the downward channel at 4850.

6.4850 is also the 61.8% Fibonacci retracement from 4951-4692. In the short term, bulls live above 4850 and bears live below 4850.

7. If the entire fall is complete from 5310-4692. Retracement levels come to 4837, 4928, 5006,5073.

1. The FIIs have been relentlessly selling. One of the reasons for the rise from march'09 was the FII money pumped in. The month of Feb already, they have sold Rs 2500 crores and for this year, almost 9500 crores from Jan'10.

2. The DIIs have propped up the market with purchases of Rs 13,500 crores. How long can they prop the market up?

3. The NTPC issue was a disaster. It got a subscription of 12000 crores against shares on offer worth 9000 crores. 4500 crores were pumped in by LIC and SBI. The government still has mega issues this financial year like REC, Sutlej Nigam which will suck the out the buying power of LIC.

4. The Dollar Index is above 80. The Dollar Carry Trade is unwinding. The easy money is gone.

5. PIGS are getting slaughtered.The problems of Portugal, Greece, Spain and Ireland are undermining the Euro. The sovereign debts of these countries can potentially tear apart the European Union. If the Euro falls, the USD is the only alternative now.

6. The Dollar strengthening makes the Emerging Markets as an unattractive investment class. The FIIs have to sell more shares to get the same amount of dollars back.

7. The Silver lining is India is better positioned to handle all this than rest of the world.

Technicals:

1. The 200 EMA at 4654 is likely to be tested this time. Bulls live above this average, the bears thrive below it. The attached chart is interesting. In bull markets, the markets take support on this level and rally. The behavior of the index at 4650 is key.

2. The 20 EMA and 50 EMA negative crossover has happened.In the bull market, this never happens.

3. The Gann supports are at 4650 taken at major turning point in March'09.

4.Short term Gann Resistance comes at 4850 which could be a shorting level.

5. The Index broke the Trendline support of lows from August which gave us support when the low of 4766. This offers first resistance at 4775 approx now. Next resistance comes at at the upper end of the downward channel at 4850.

6.4850 is also the 61.8% Fibonacci retracement from 4951-4692. In the short term, bulls live above 4850 and bears live below 4850.

7. If the entire fall is complete from 5310-4692. Retracement levels come to 4837, 4928, 5006,5073.

Thursday, 4 February 2010

Subscribe to:

Comments (Atom)